unrealized capital gains tax california

There are primarily three tax benefits made with the creation of OZs. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

The Coming Tax On Unrealized Capital Gains Youtube

Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. For most people the long-term capital gains tax rate is 15 20. Unrealized capital gains tax california Sunday June 19 2022 Edit.

Contact a Fidelity Advisor. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Individual Income Tax Return IRS Form.

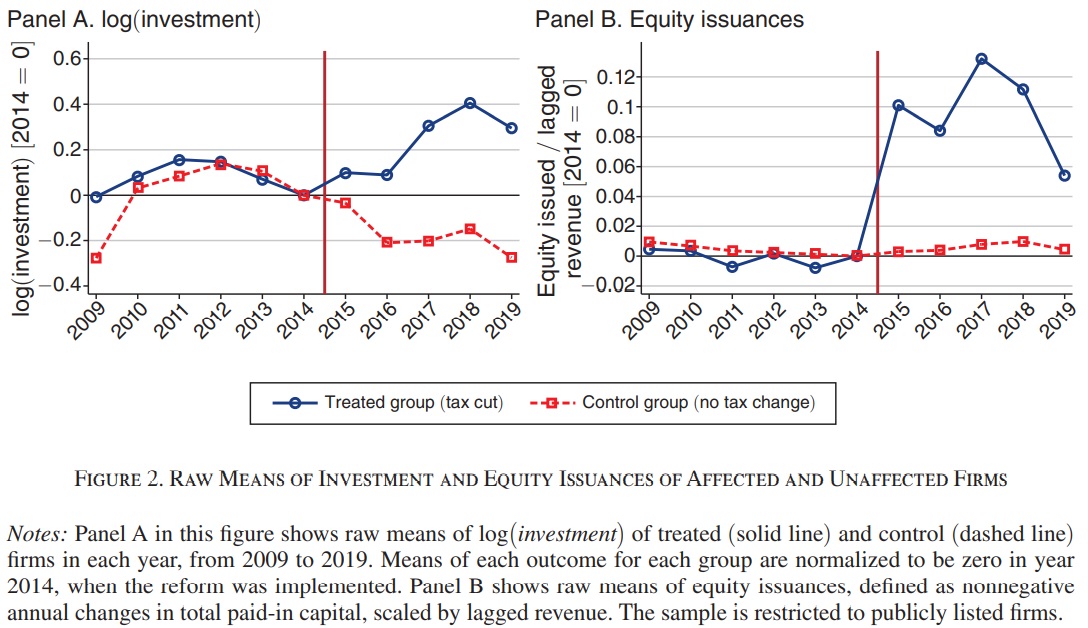

In California HSA accounts are treated as a normal investment account. The Problems With an Unrealized Capital Gains Tax. What is the capital gains tax rate.

Long-term capital gains are gains on investments you. The problem may be with your improper use of the terms realized and. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

In addition to taxing unrealized. Talk of California adopting a tax on paper profits or unrealized capital gains. An additional 1 tax on income over 1 million 3.

Register and Subscribe Now to work on your CA Schedule D 540 more fillable forms. The amount youll pay in capital gains taxes depends primarily on how long. Track Clients Potential Tax Liability with Tax Evaluator.

Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax. Californias proposed wealth tax Bill 2028 would apply for a decade to anyone. An unrealized capital gains tax is a tax on profits that didnt realize yet.

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Urban Catalyst is a leader in QOZ investing. Urban Catalyst is a leader in QOZ investing.

California taxes all capital gains as income. That said Californias tax system does give Musk a big and perverse. California taxes capital gains at the same rate as regular income.

Contact a Fidelity Advisor. The capital gains tax rate California currently plans for is one that can vary widely. Wealth tax on millionaires.

Complete Edit or Print Tax Forms Instantly. To report your capital gains and losses use US. Now that weve looked at.

Its a tax on profits. Ad Access Tax Forms. Any investments youve made that have appreciated over time that.

Under current rules any gain would be subject to long-term capital gains tax. Track Clients Potential Tax Liability with Tax Evaluator.

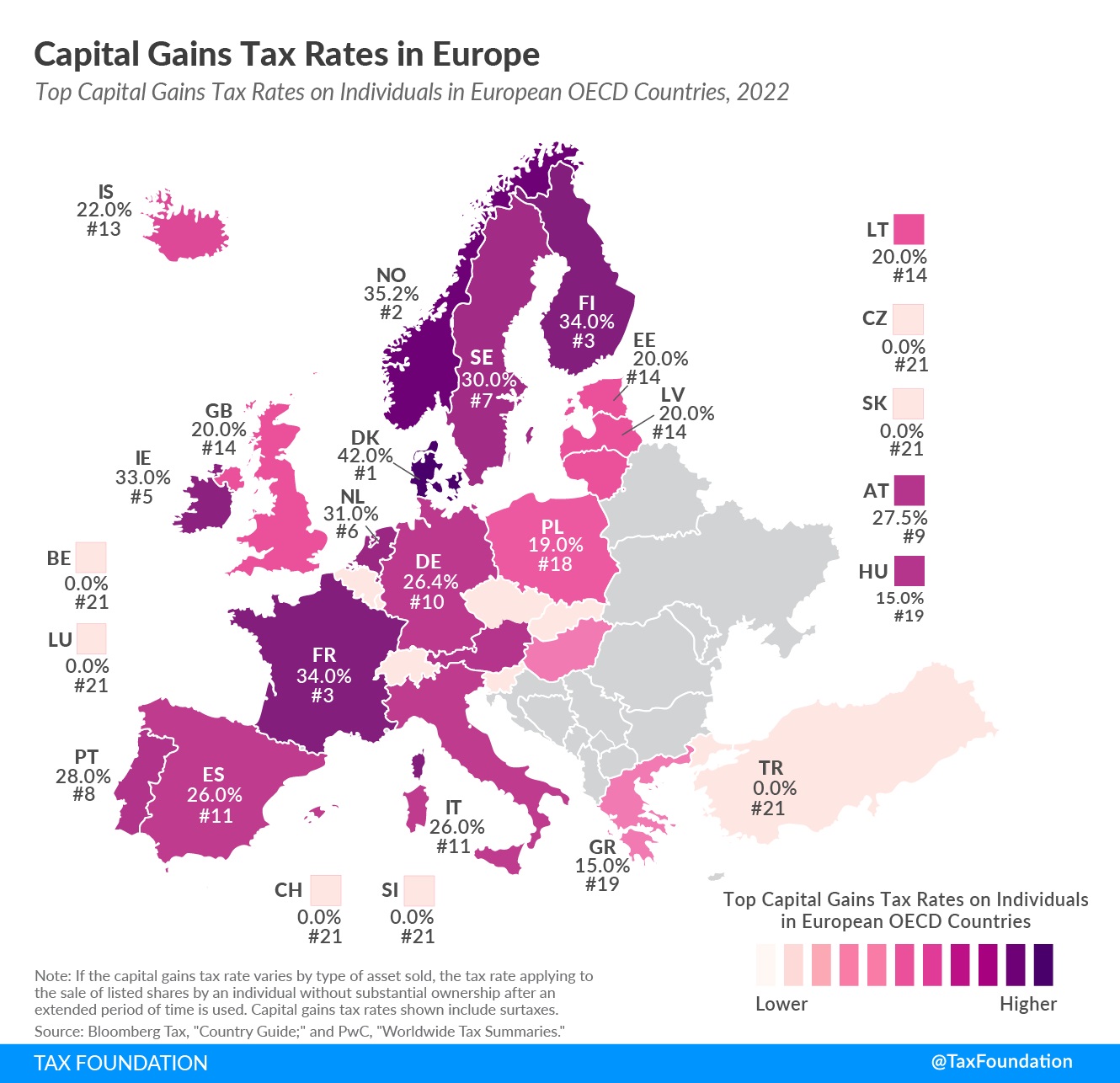

Capital Gains Tax International Liberty

Capital Gains Tax International Liberty

California And New Jersey Hsa Tax Return Special Considerations

State Leaders Propose Wealth Tax On Ultra Rich California Teachers Association

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Epic Games Tim Sweeney Says Democrats Unrealized Capital Gains Tax On Billionaires Would Crush Entrepreneurs Fox Business

California Capital Gains Tax Enjoy Oc

Pressure Rises For California Wealth Tax Plan To Return In 2021

Reduce Capital Gains Tax On The Sale Of Your Business Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Opposed To The Unrealized Capital Gains Tax R Elonmusk

Unrealized Capital Gains Tax Archives California Globe

State Taxes On Capital Gains Center On Budget And Policy Priorities

Avoiding Basis Step Down At Death By Gifting Capital Losses

Capital Gains Taxes Are Going Up Tax Policy Center

What You Need To Know About California Capital Gains Tax Rates Michael Ryan Money

Capital Gains Tax Breaks Are Finally On The Defensive Itep

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

Ending Special Tax Treatment For The Very Wealthy Center For American Progress